Go Global with Unlimited Advantage

Why students trust GlobCred for their credit journey

Access to 60+ Global Lenders

Interest Rates Starting from 8% p.a.

Study Now, Pay Later

Living Expense Coverage

Instant Sanction

Collateral-Free Loan Options

No Parent Financials Needed

No Foreclosure Charges

Dedicated Counselling Service

Simply a Better Way

Simple. Smart. Swift: Your Credit Journey with GlobCred

Fill a single smart application

Get matched real-time with best lenders

Instant Sanction

Quick disbursement pre visa

Trusted by 13,000+ Students

$72M+

Loan

Sanctioned

700+

Partnered

Universities

60+

Global

Lenders

Our Global Lenders

Backed by a trusted network of global financial institutions, we connect students with the most competitive and student-friendly loan options worldwide.

University Partners

Collaborating with top universities across the globe to ensure seamless admission and funding support for aspiring students.

AI-Powered Lending, Designed for Your Future

Fast API Integration

AI Matching Engine

Real-Time Approvals

Transparent, Paperless, Hassle-Free

Global Footprint, Global Impact.

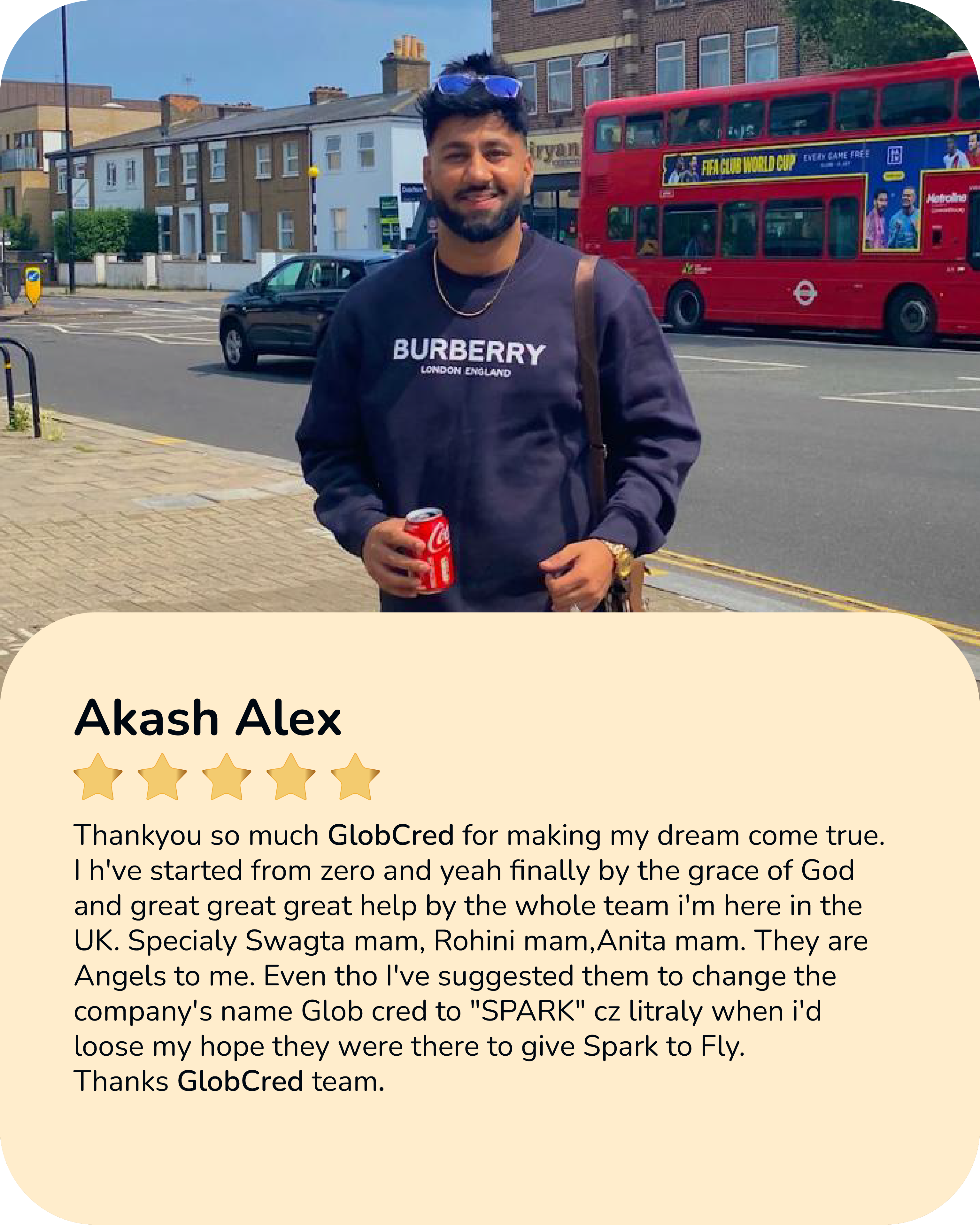

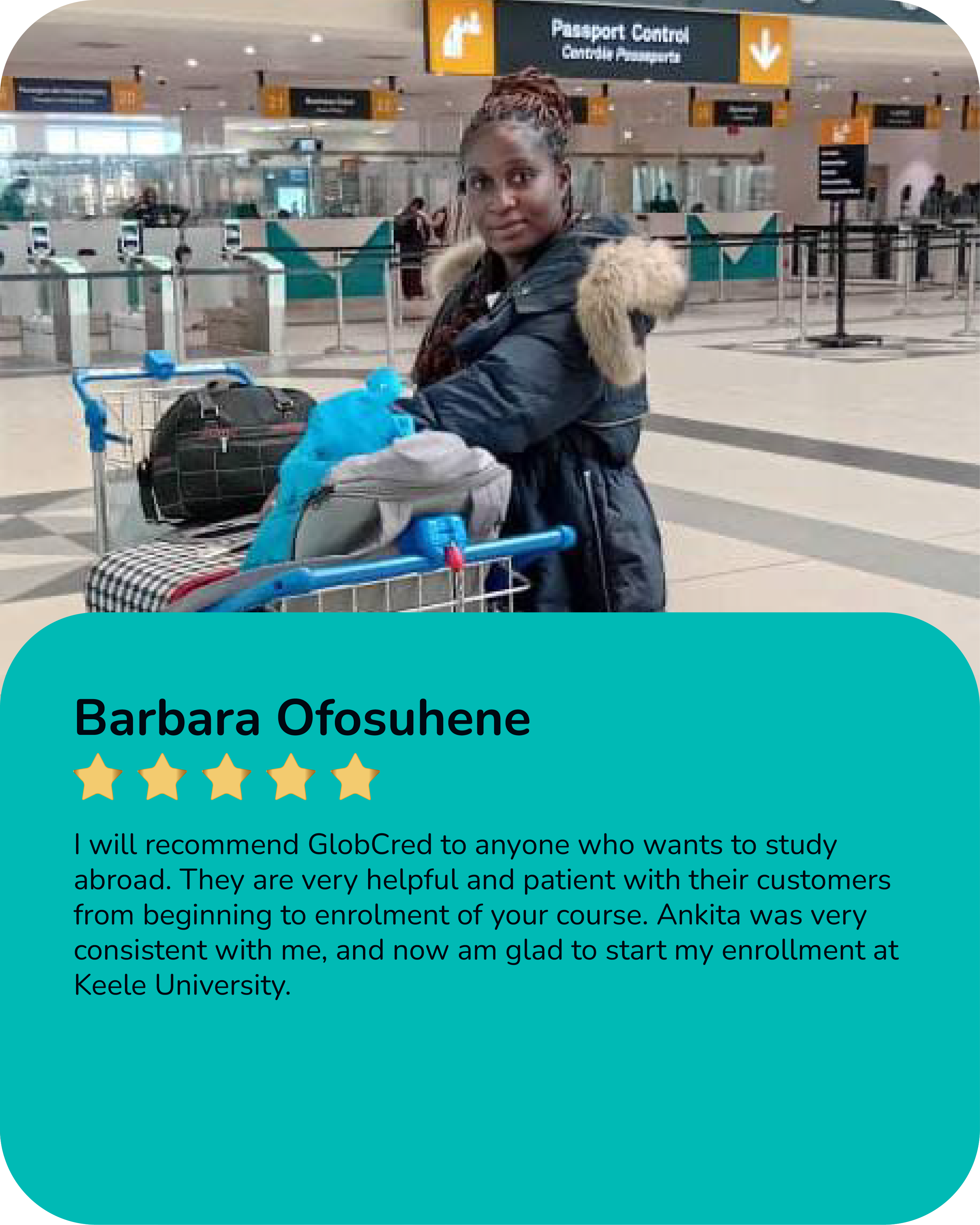

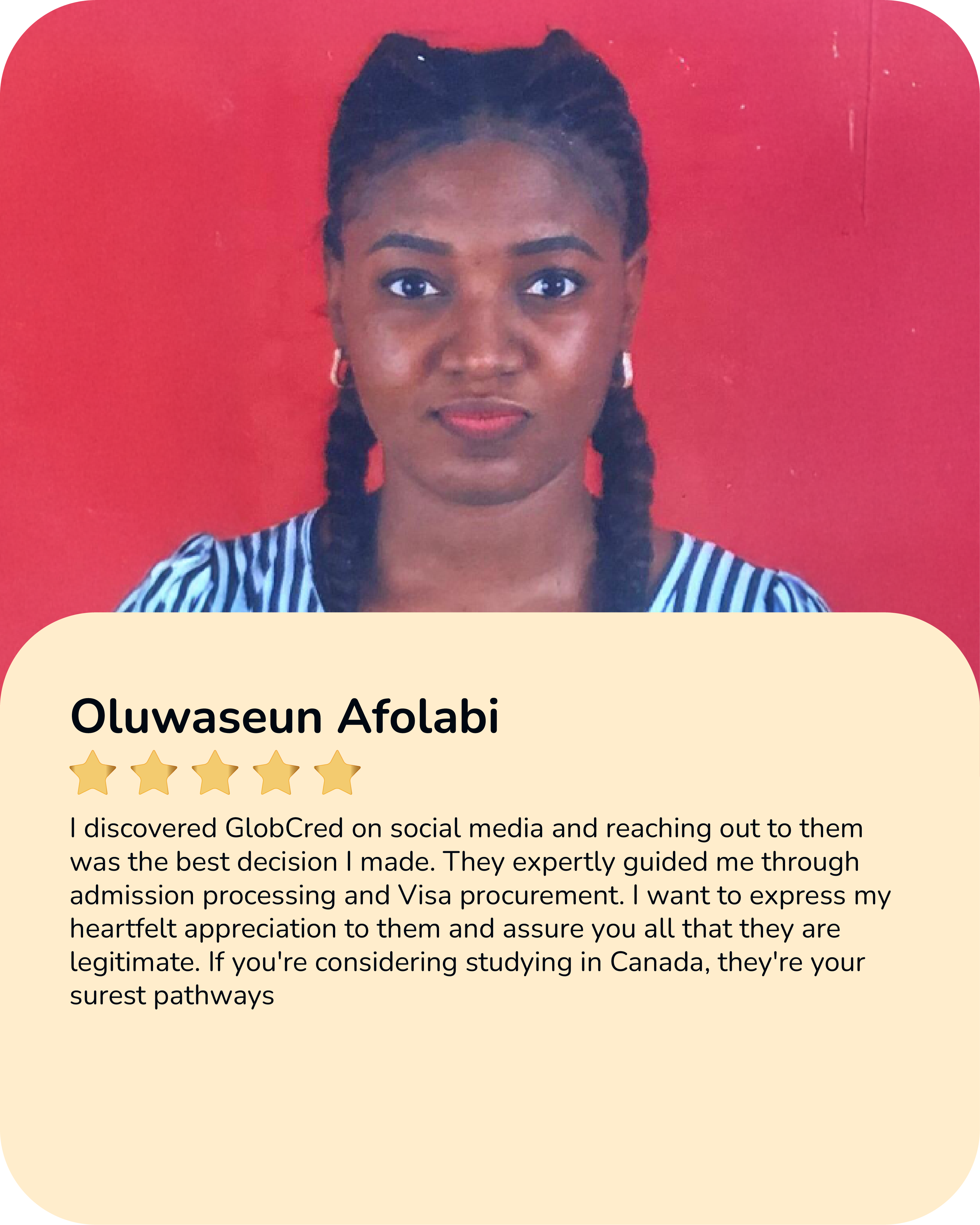

Real stories. Real impact.

Frequently Asked Questions

Got Questions? We’ve Got Answers.