Built for Scale

From India to Brazil to Africa, GlobCred operates a global infrastructure that supports students at every step—from your first application through final visa approval. Our 700+ institutional partners ensure seamless coordination across lenders, universities, and immigration processes.

How We Work

The GlobCred Advantage: Speed, Transparency, and Global Reach

One application, 60+ lenders

Submit your profile once. Get matched with multiple lenders instantly. Compare interest rates, repayment terms, and loan amounts—all in your dashboard. No multiple applications. No hassle.

100% Digital, Paperless & Mobile-First

Complete your entire application on your phone in under 15 minutes. No branch visits. No physical documents. Upload everything digitally. Get decisions faster.

Globally Scalable & Compliant

RBI-compliant flows. GDPR-ready infrastructure. Bank-grade encryption. We operate across 25+ countries with full regulatory compliance at every step.

No Hidden Charges, Ever

Complete transparency. Exact fees shown before you apply. No surprise processing charges. No hidden GST. What you see is what you pay.

Trusted by 700+ University Partners

700+ universities, 60+ lenders, and 1,000+ education agents recommend GlobCred to their students. Join thousands of students who've successfully secured funding.

Our Growth Featured in Leading Media

GlobCred is advancing its AI-led student ecosystem through Aveka, the company's consumer platform designed to support GenZ

Read more

GlobCred Hits USD 65M Sanctions Rate, 7 Countries -- Expands AI Platform for Global Talent. GlobCred, a fast-scaling global fintech

Read more

A fast-scaling global fintech headquartered in Dubai with strategic operations across Mumbai, Dubai, and London, is transforming access to international education.

Read moreOur Mission

We’re not here to sell loans or move money. We’re here to empower ambition. Every person crossing a border deserves tools that work across them. GlobCred builds those tools—so you don’t pause your dreams because of paperwork or payment delays.

Trusted by 13,000+ Students

$72M+

Loan

Sanctioned

700+

Partnered

Universities

60+

Global

Lenders

Global Footprint, Global Impact.

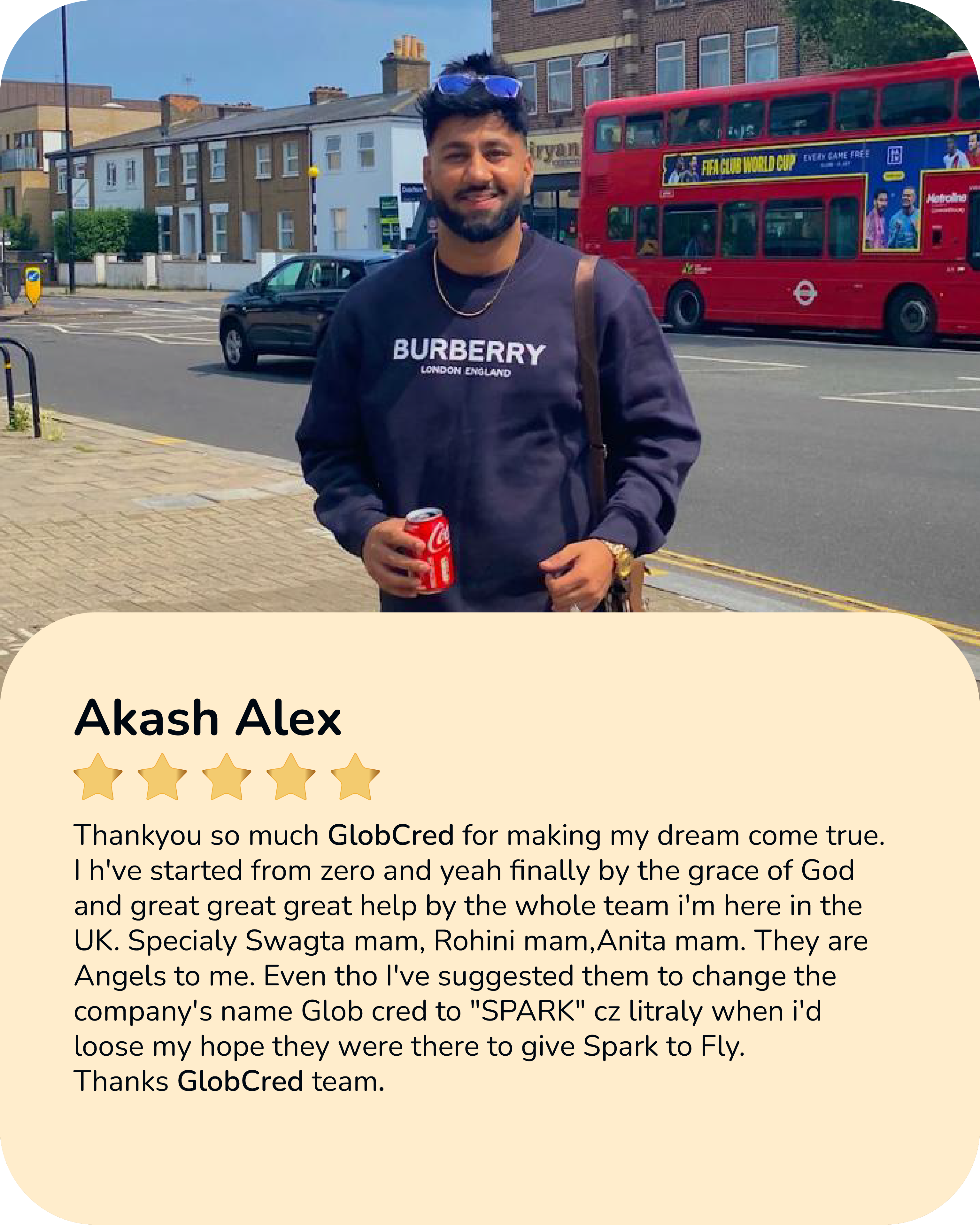

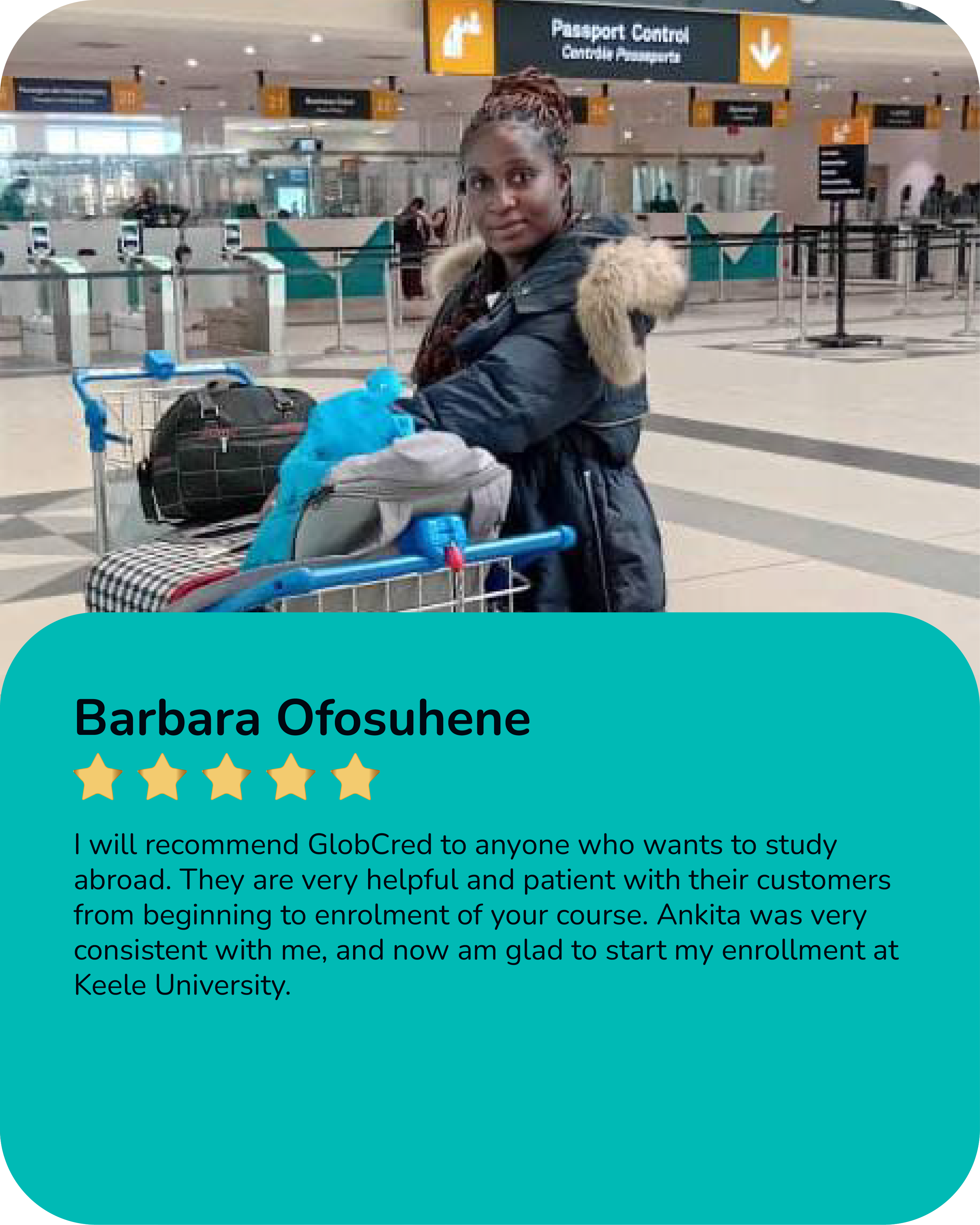

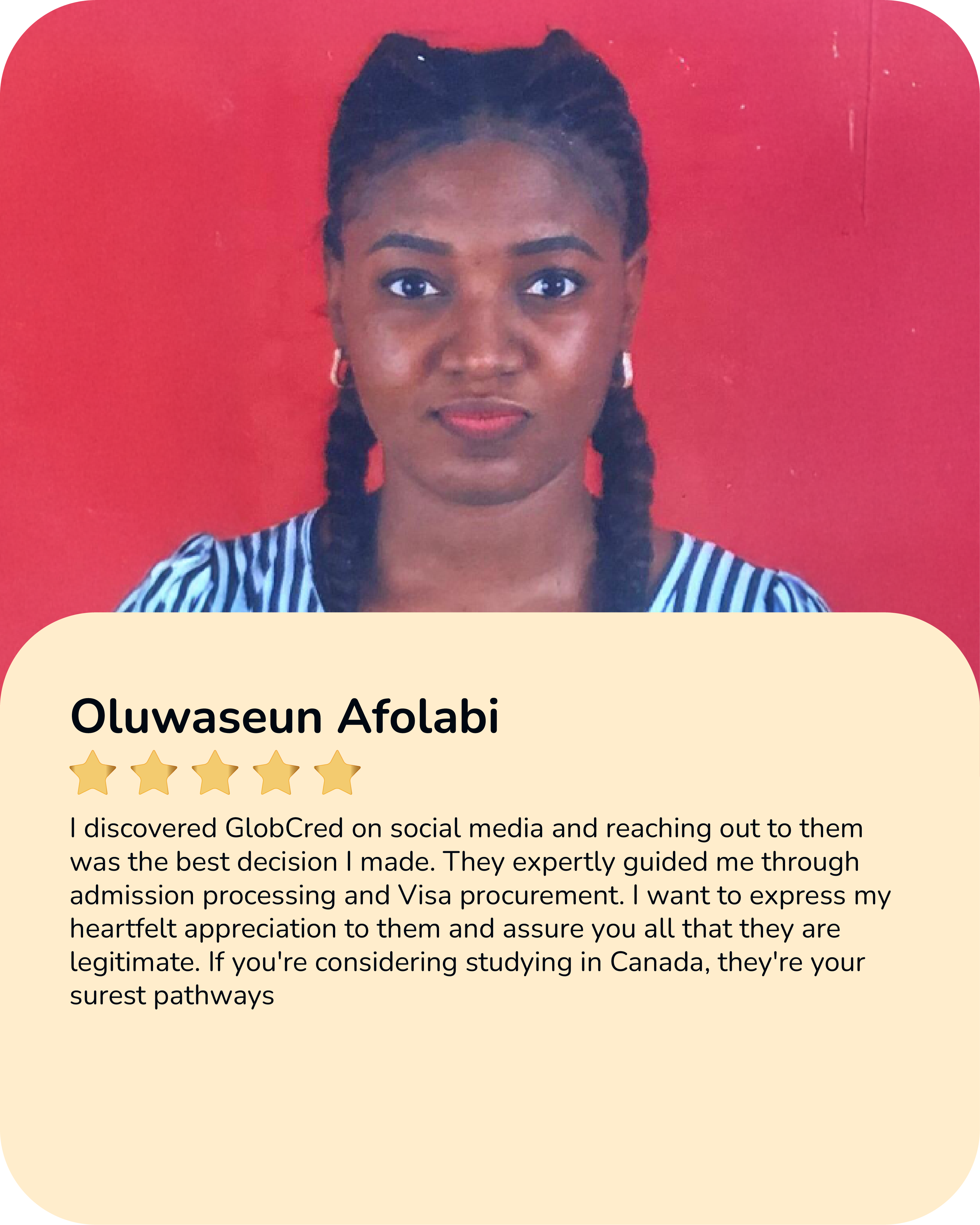

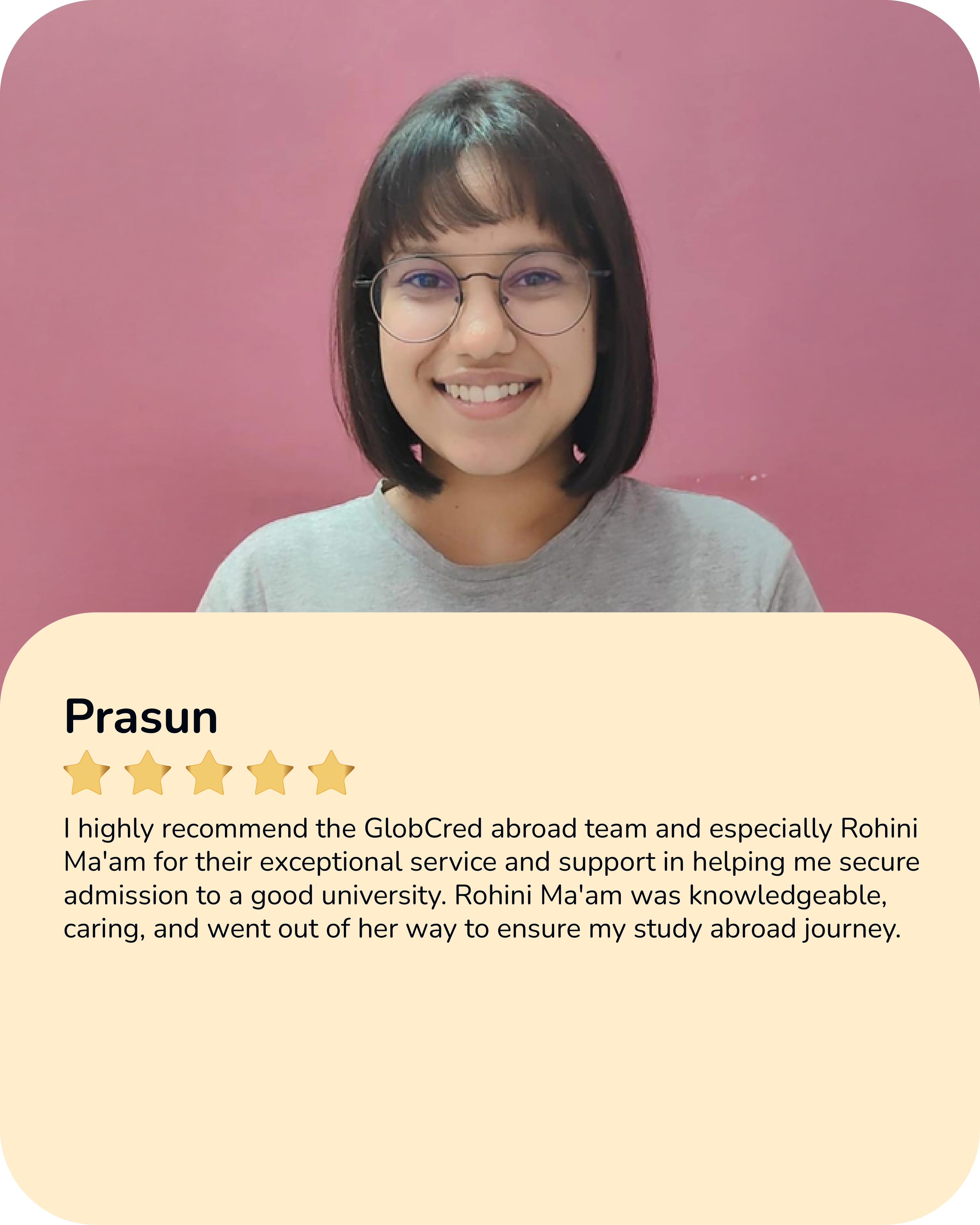

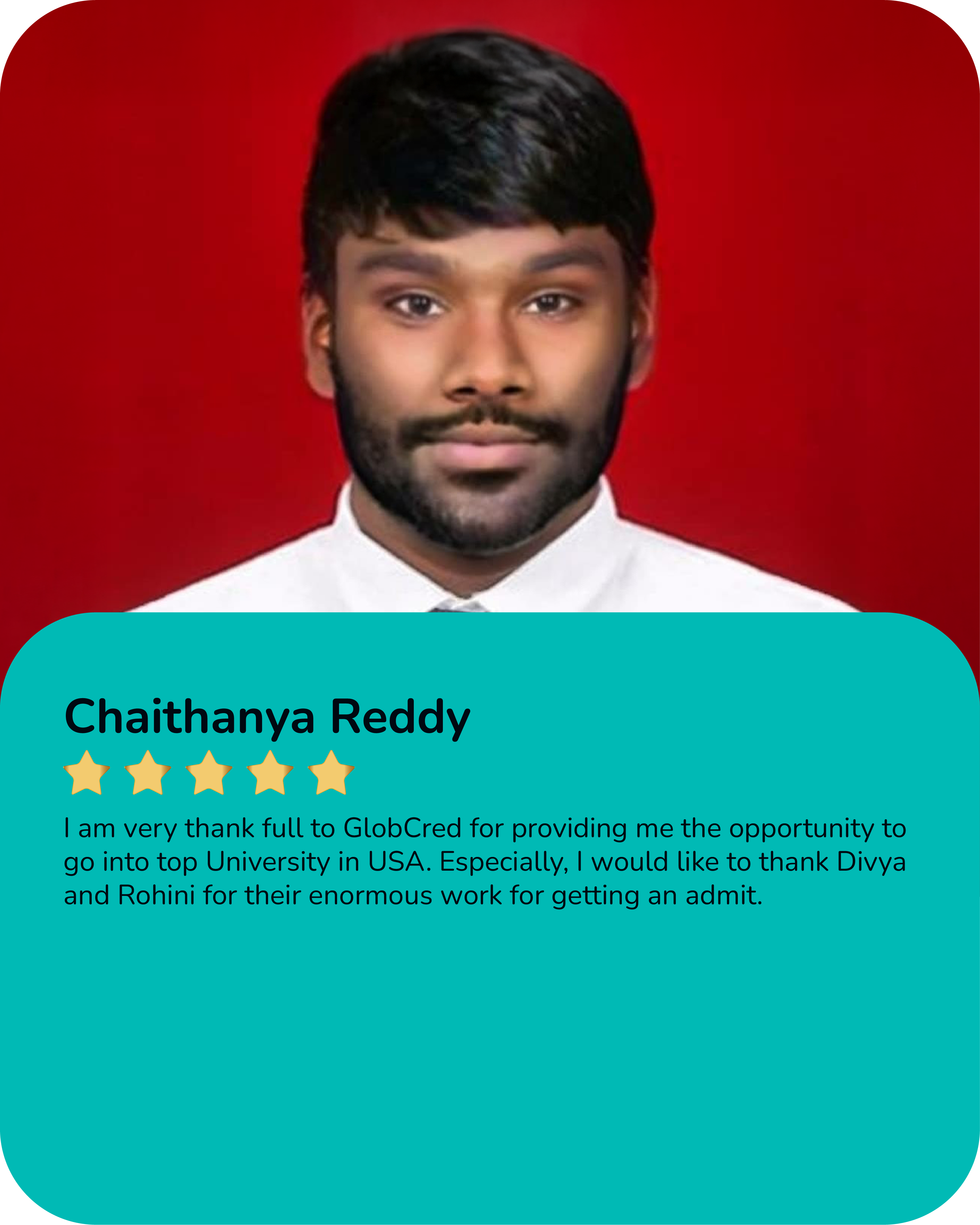

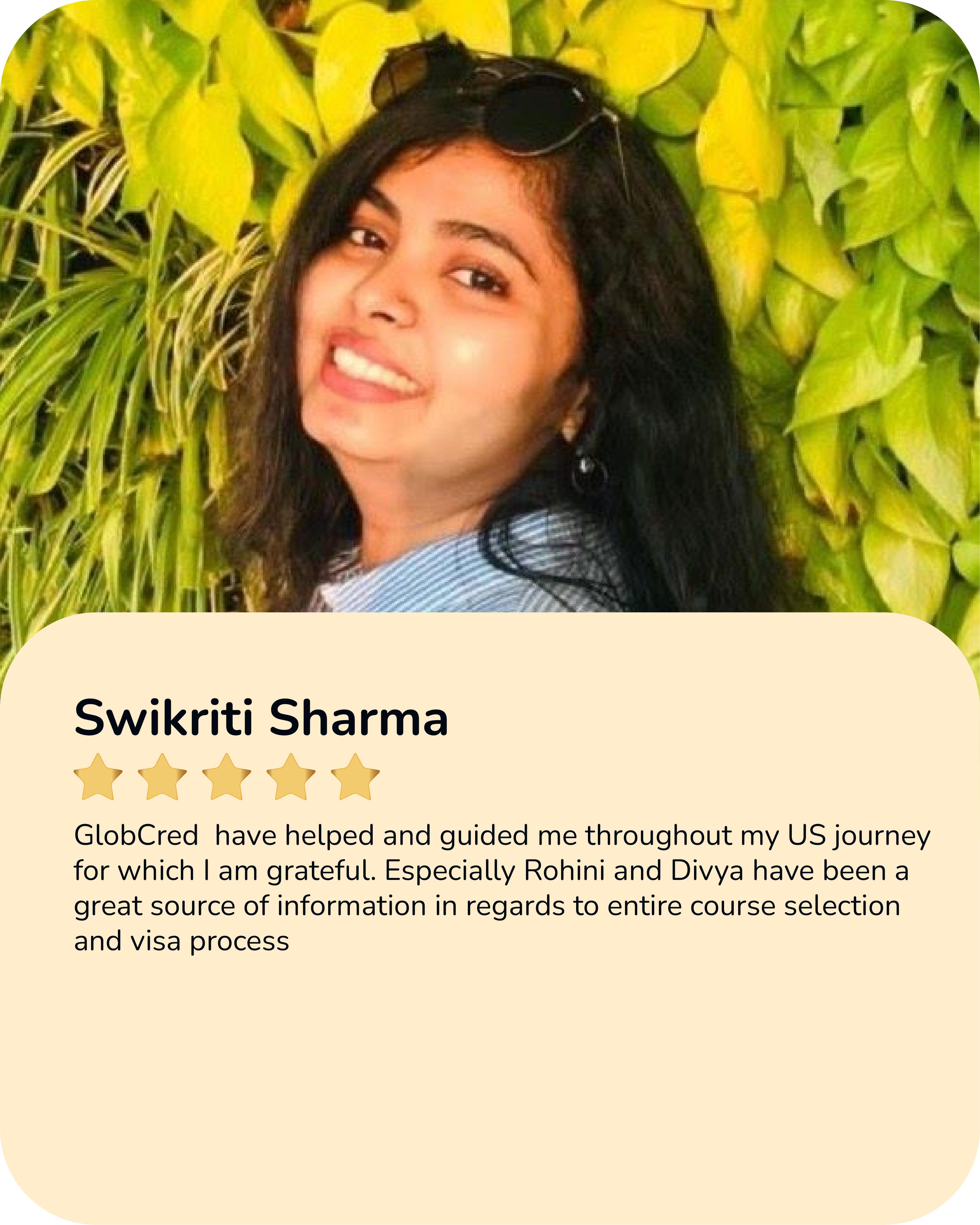

Real stories. Real impact.